Table of Contents

Introduction

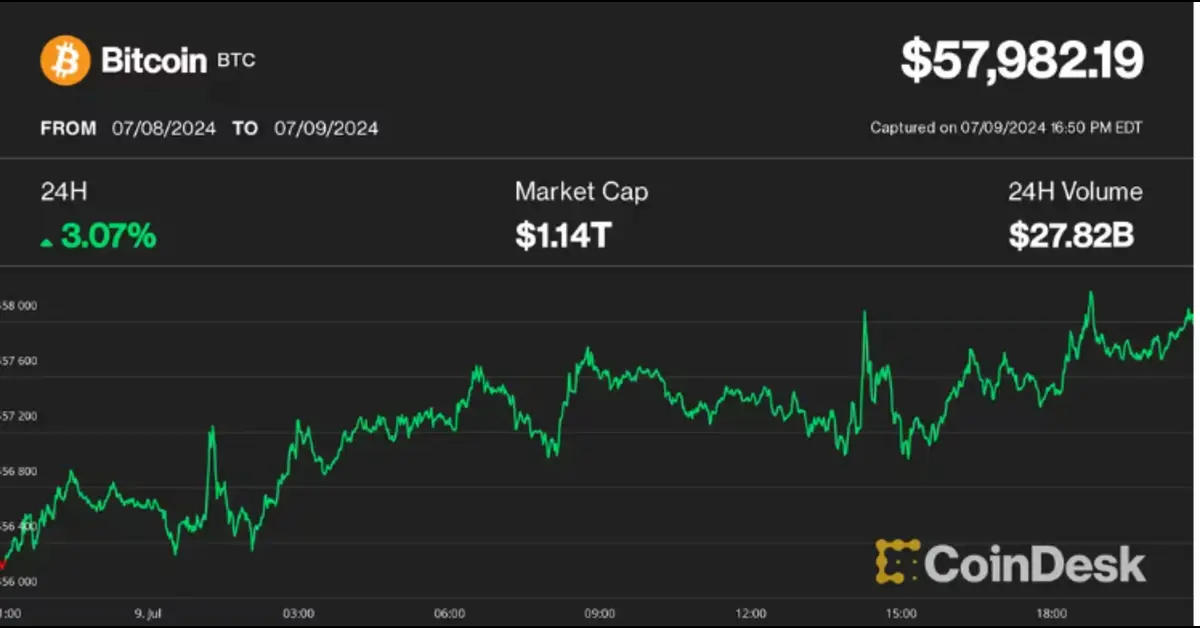

Bitcoin has once again captured the spotlight with its recent price movement, rebounding toward the $60K mark. As the flagship cryptocurrency, performance is a crucial indicator for the entire crypto market. But despite this bullish trend, analysts warn that market choppiness is likely to persist.

Current Market Scenario

Bitcoin has made significant strides, nearing the $60K threshold. This rebound is a breath of fresh air for investors who witnessed a turbulent market in recent months. The surge is attributed to various factors, including increased institutional interest, positive regulatory news, and a growing acceptance of cryptocurrencies.

Market Volatility and Choppiness

Market volatility refers to the rapid and unpredictable price movements seen in financial markets. For Bitcoin, this volatility is a double-edged sword. While it creates opportunities for profit, it also introduces significant risk. Analysts suggest that despite the recent uptrend, the crypto market will continue to experience choppiness due to several underlying factors.

Analysts’ Predictions and Insights

Leading cryptocurrency analysts provide a mix of short-term and long-term predictions. In the short term, we might see testing new highs, but this will be accompanied by sharp corrections. Long-term predictions remain optimistic, with expectations of surpassing its previous all-time highs in the future.

Factors Contributing to Market Choppiness

- Regulatory News and Impacts: Regulations play a pivotal role in the crypto market. Positive news can drive prices up, while restrictive regulations can cause significant downturns.

- Economic Indicators: Economic health indicators, such as inflation rates and employment data, can influenceprice.

- Market Sentiment and Investor Behavior: The crypto market is heavily influenced by investor sentiment, which can be swayed by news, social media trends, and market rumors.

Technical Analysis

Technical analysis involves examining historical price charts and using indicators to predict future movements. Key support and resistance levels for Bitcoin are essential for understanding potential price floors and ceilings. Indicators like Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands are widely used to gauge market trends.

Historical Performance of Bitcoin

Bitcoin’s price history is marked by several boom and bust cycles. Understanding these patterns helps in drawing parallels with current trends. For instance, the current rebound is reminiscent of previous recoveries after significant corrections.

Impact of Institutional Investments

Institutional investors have played a significant role in price movements. Large purchases by companies and investment funds provide both price support and legitimacy to . Recent activities, such as investments by major firms, have contributed to the current price surge.

Impact of Global Economic Conditions

Global economic trends significantly impact Bitcoin. Events like central bank policies, geopolitical tensions, and economic crises can lead to increased buying as a hedge against traditional financial markets. Keeping an eye on these events can provide insights into Bitcoin’s future movements.

Bitcoin and Other Cryptocurrencies

While Bitcoin remains the market leader, other cryptocurrencies also influence its price. Ethereum, for example, often moves in tandem with but can also diverge due to its unique factors. Analyzing correlations helps in understanding broader market dynamics.

Future Outlook for Bitcoin

Analysts have a bullish long-term outlook for . Factors such as growing mainstream adoption, technological advancements, and increased regulatory clarity are expected to drive value higher in the coming years.

Investing in Bitcoin

Investing in Bitcoin has its pros and cons. On the plus side, it offers high potential returns and diversification benefits. However, it also comes with high volatility and regulatory uncertainties. New investors should carefully weigh these factors before diving in.

Risks Associated with Bitcoin Investment

Investing in involves several risks:

- Market Risks: High volatility can lead to significant losses.

- Regulatory Risks: Government regulations can affect legality and price.

- Security Risks: The risk of hacks and fraud is ever-present in the crypto world.

Tips for Navigating the Volatile Market

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread investments across various assets.

- Stay Informed: Keep up with the latest news and trends in the crypto market.

- Have a Long-Term Perspective: Be prepared for short-term volatility and focus on long-term gains.

Conclusion

Bitcoin’s recent rebound toward $60K is an exciting development for the crypto market. However, the journey ahead is likely to remain choppy. Investors should stay informed, manage risks, and maintain a long-term perspective to navigate this volatile market successfully.

Crypto: Notcoin Explodes by 50% in 24 Hours!

FAQs

What factors are driving Bitcoin’s recent rebound? Bitcoin’s recent rebound is driven by increased institutional interest, positive regulatory news, and a growing acceptance of cryptocurrencies.

Why is market choppiness likely to persist? Market choppiness is likely to persist due to regulatory uncertainties, economic indicators, and fluctuating investor sentiment.

How do institutional investments impact Bitcoin? Institutional investments provide price support and legitimacy to often driving up prices with large purchases.

What should new investors consider before investing in Bitcoin? New investors should consider the high volatility, regulatory uncertainties, and security risks associated with investment.

What are the key risks associated with Bitcoin investment? The key risks include market volatility, regulatory changes, and potential security threats like hacks and fraud.