Introduction: Understanding the Crypto Market Rollercoaster

In this article, we’ll dissect the recent tumultuous events in the cryptocurrency market, focusing on the sharp decline witnessed by Bitcoin and other altcoins. From the sudden plunge in Bitcoin’s value to the ripple effect on smaller cryptocurrencies, we’ll explore the factors contributing to this downturn.

1. The Rapid Descent: Bitcoin’s Price Plunge

1.1 A Rollercoaster Ride: Bitcoin’s Drastic Movement

The article kicks off by examining the significant drop in Bitcoin’s price, plummeting below $66,000 from a recent high of $71,000 within hours.

2. Ether and the Altcoin Avalanche

2.1 Ether’s Slide: Impact on the Second-Largest Cryptocurrency

We delve into the repercussions of Bitcoin’s decline on Ether, which experienced a sharp 12% drop to $3,100 before a partial recovery.

2.2 The Domino Effect: Smaller Cryptos Follow Suit

The article outlines the broader implications for smaller cryptocurrencies, including Cardano’s ADA, Avalanche’s AVAX, bitcoin cash (BCH), filecoin (FIL), and aptos (APT), which witnessed losses ranging from 15% to 20%.

3. Market Dynamics and Leverage Washout

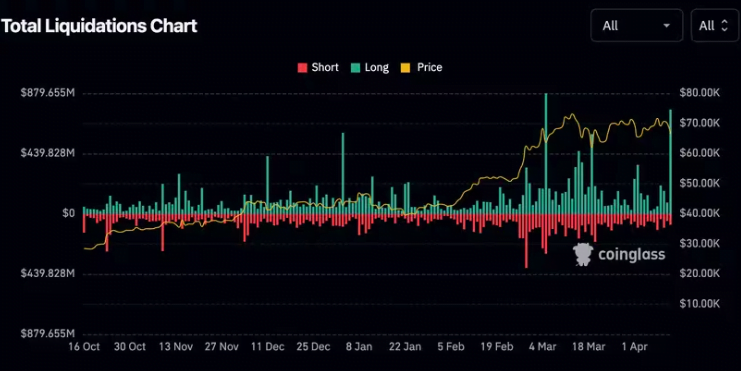

3.1 Leveraged Trading Fallout: Unpacking the $850 Million Liquidation

We analyze the cascading effect of the market downturn, resulting in the liquidation of approximately $850 million worth of leveraged derivatives trading positions across digital assets.

4. External Factors and Geopolitical Risks

4.1 Global Events Impacting Crypto: The Role of Geopolitical Uncertainty

The article explores the influence of broader geopolitical tensions, such as escalating conflict in the Middle East, on the cryptocurrency market’s volatility.

5. Safe-Haven Assets and Market Sentiment

5.1 Flight to Safety: Traditional Safe-Haven Assets Rally

We examine the flight of investors to traditional safe-haven assets like Treasury bonds, the U.S. dollar index (DXY), and gold amidst the market turmoil.

6. Insights and Long-Term Outlook

6.1 Weathering the Storm: Predictions and Perspectives

The article concludes with insights from digital asset investment firm Ryze Labs, offering a long-term perspective on the crypto market amidst short-term uncertainties.

Conclusion: Navigating Volatility in the Crypto Space

In conclusion, the recent market turbulence underscores the inherent volatility of the cryptocurrency landscape. However, amidst short-term setbacks, the industry maintains a resilient outlook, driven by evolving market dynamics and investor sentiment.

FAQs (Frequently Asked Questions)

1. Why did Bitcoin experience such a sharp decline?

Bitcoin’s plunge can be attributed to a combination of factors, including geopolitical tensions and market sentiment.

2. How did Ether and other altcoins fare during this downturn?

Ether and smaller cryptocurrencies witnessed significant losses, reflecting the broader market volatility.

3. What role did leveraged trading play in exacerbating the market downturn?

Leveraged trading magnified the impact of the market decline, resulting in substantial liquidations across digital assets.

4. Are traditional safe-haven assets still relevant amidst the rise of cryptocurrencies?

The recent rally in traditional safe-haven assets highlights their continued significance during periods of market uncertainty.

5. What can investors expect in the long term for the cryptocurrency market?

Despite short-term challenges, industry experts maintain a positive long-term outlook, anticipating resilience and growth in the crypto space.