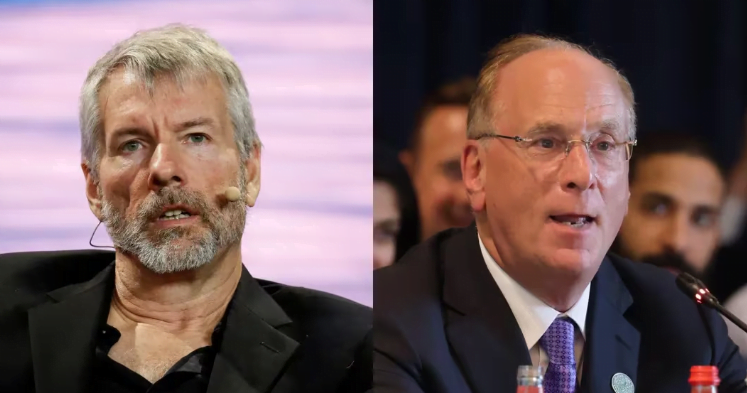

In a remarkable development, the BlackRock iShares Bitcoin ETF (IBIT) has quickly risen to prominence, surpassing MicroStrategy in bitcoin holdings in less than two months of its existence. The latest disclosure from the fund revealed that IBIT held 195,985 bitcoin on Friday, outpacing MicroStrategy’s holdings of 193,000 tokens as of Feb. 26.

IBIT’s rapid accumulation of bitcoin has been fueled by significant inflows, with the fund often adding hundreds of millions of dollars worth of bitcoin on a daily basis since its launch on Jan. 11. This surge in holdings has established IBIT as one of the largest spot products in the market, second only to the Grayscale Bitcoin Trust.

While MicroStrategy’s holdings may have increased since Feb. 26, the company’s recent $700 million capital raise suggests intentions to purchase more bitcoin, further contributing to the growing demand for the cryptocurrency.

The massive demand for spot ETFs like IBIT has been a driving force behind bitcoin’s remarkable price surge, which has seen the cryptocurrency surpass $70,000 for the first time ever. This surge represents a more than 60% increase in price since the beginning of the year, signaling strong investor interest and confidence in bitcoin’s potential.

As bitcoin continues to attract institutional investment through products like IBIT and MicroStrategy’s ongoing accumulation efforts, the cryptocurrency market remains dynamic and volatile. At present, bitcoin is trading just under the $70,000 mark, reflecting the ongoing bullish sentiment among investors.

The rise of the BlackRock iShares Bitcoin ETF highlights the growing institutional acceptance and adoption of cryptocurrencies, further solidifying bitcoin’s position as a viable investment asset in traditional financial markets.