Table of Contents

Manish Chokhani, a prominent figure in India’s financial landscape, recently expressed optimism about the Indian market potentially receiving significant inflows of $60-70 billion. This statement has sparked discussions and analysis within the financial community regarding the factors driving such potential inflows, their impact on the Indian economy, associated challenges, and strategies for managing these inflows effectively.

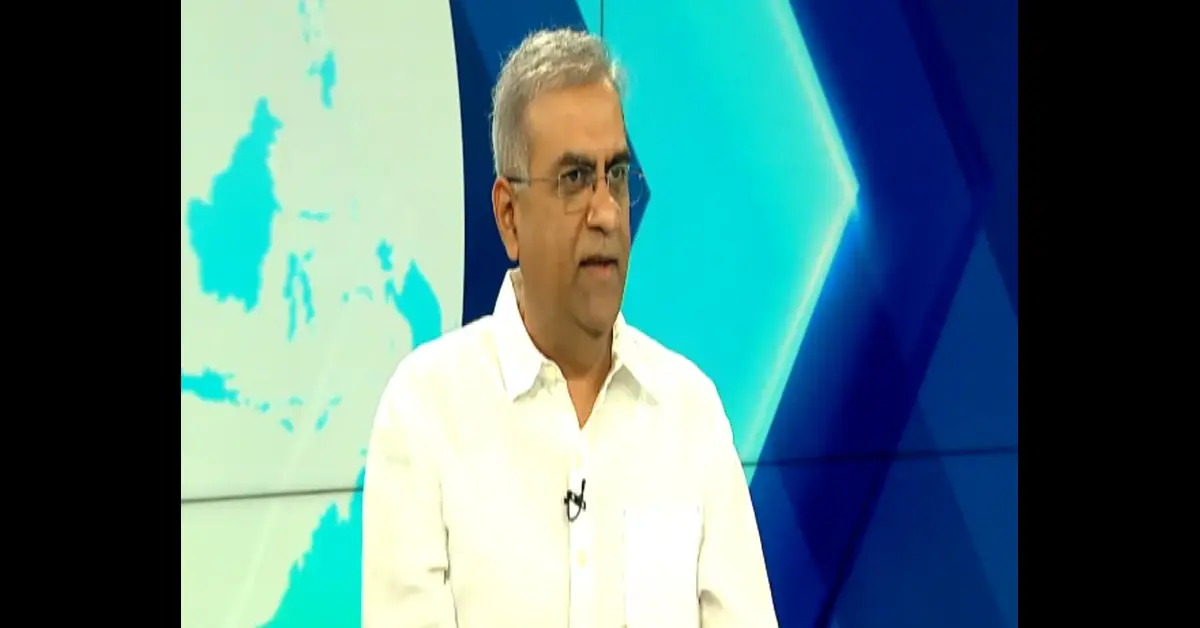

Introduction to Manish Chokhani’s Statement

Manish Chokhani, a respected investor and market expert, shared his insights on the Indian market’s prospects, indicating a positive outlook regarding substantial inflows of foreign investment.

Factors Driving Potential Inflows

Economic Reforms and Stability

India’s ongoing economic reforms and policy stability have attracted the attention of global investors. The government’s initiatives aimed at ease of doing business, infrastructure development, and sector-specific reforms have bolstered confidence in India as an attractive investment destination.

Global Investment Trends

Global investment trends, including shifts in capital allocation due to geopolitical factors and diversification strategies by institutional investors, contribute to the potential inflows into emerging markets like India.

Impact on Indian Economy

Strengthening of Rupee

Significant foreign inflows can lead to a strengthening of the Indian rupee against major currencies, which can have implications for trade balances and foreign exchange reserves.

Boost to Capital Markets

Increased foreign investment can boost liquidity and depth in Indian capital markets, supporting the growth of domestic businesses and facilitating capital formation.

Challenges and Risks

Overheating Concerns

Rapid inflows of capital can pose challenges such as asset price inflation, overheating in certain sectors, and potential risks of market bubbles.

External Factors

External factors like global economic conditions, geopolitical tensions, and policy changes in major economies can influence the stability and sustainability of foreign inflows into India.

Strategies for Managing Inflows

Regulatory Measures

Regulatory authorities may implement measures to manage capital inflows effectively, including prudential regulations, monitoring of foreign exchange markets, and coordination with monetary policy.

Investment Diversification

Encouraging diversification of investments across sectors and asset classes can mitigate risks associated with concentrated capital inflows.

ixigo IPO: Strong Demand and High GMP 2024

Conclusion

Manish Chokhani’s optimistic outlook reflects the potential for significant foreign inflows into the Indian market, driven by economic reforms, global investment trends, and investor confidence. While these inflows can bring benefits such as currency strength and market development, they also pose challenges that require proactive regulatory and strategic measures.