Analyzing the Impact of RBI Monetary Policy Decisions

Introduction to RBI Monetary Policy Updates

The Reserve Bank of India (RBI) recently announced its monetary policy decisions for the upcoming period, shedding light on crucial aspects of economic management and growth projections. Let’s delve into the key highlights and implications of these updates.

Key Decisions of the RBI Monetary Policy Committee

The Monetary Policy Committee (MPC) convened to address critical issues affecting the Indian economy. Here’s a breakdown of the major decisions taken:

- Repo Rate Unchanged at 6.5%

- GDP Growth Projection for FY25

- Inflation Forecast and Outlook

Analysis of Policy Highlights

The RBI’s decisions carry significant implications for various aspects of the economy:

- Impact on Economic Growth: The unchanged repo rate signals stability in monetary policy, providing a conducive environment for economic growth. The GDP growth projection for the fiscal year 2024-25 underscores the central bank’s commitment to fostering sustainable development.

- Implications for Inflation: With a focus on maintaining inflation within target levels, the RBI’s inflation forecast and outlook provide insights into price stability measures. The central bank’s vigilance towards inflationary pressures reflects its proactive stance in safeguarding economic stability.

- Forex Reserves and External Vulnerability: The management of forex reserves and addressing external vulnerabilities remain key priorities for the RBI. Insights into India’s external sector resilience and vulnerability indicators offer valuable perspectives on economic resilience.

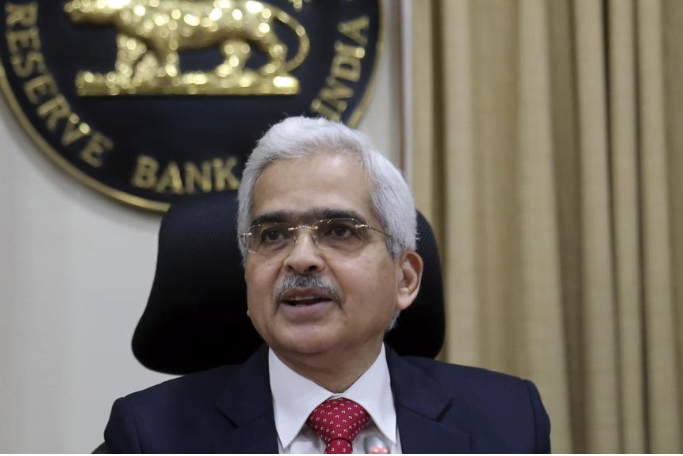

Governor’s Statements and Insights

RBI Monetary Policy Governor Shaktikanta Das’ statements provide valuable insights into the rationale behind the policy decisions:

- Addressing Inflation Concerns: Governor Das addresses concerns related to inflation dynamics, highlighting the need for a balanced approach to monetary policy. The focus on anchoring inflationary expectations underscores the central bank’s commitment to price stability.

- Economic Resilience and Policy Space: The Governor’s remarks on economic resilience and policy space reflect confidence in India’s growth prospects. The emphasis on an actively disinflationary monetary policy underscores the RBI’s commitment to achieving sustainable economic outcomes.

Conclusion

The RBI’s monetary policy updates play a pivotal role in shaping India’s economic trajectory. By balancing growth objectives with inflation management, the central bank aims to foster a conducive environment for sustainable development and stability.

FAQs: Addressing Common Queries about RBI Monetary Policy

- What is the repo rate, and why is it significant?

- How does the GDP growth projection impact the economy?

- What factors influence the RBI’s inflation forecast?

- How do forex reserves contribute to economic resilience?

- What is the role of the MPC in shaping monetary policy decisions?